Meet your customers where they are. A majority of the customers at most Banks and Credit Unions today have just one single product. This makes cross selling and upselling to existing customers and members a clear strategy to achieve quick and substantial returns if you can implement it quickly.

Confer Lending’s Platform was built with this in mind. Our platform layers on top of your existing systems and digital footprint to serve pre-approved loan offers to your your customers in a manner that makes these offers more visible to them and much easier to accept and finalize. This offers added convenience to your customers while reducing loan processing workloads.

Loans Before Confer

Physical and electronic mailings to customers

Only a small fraction of recipients actually see the offers and even those who maybe interested don’t all respond as they are deterred by the lengthy and time-consuming paperwork

The same paperwork eventually makes it back to you and burdens your staff and distracts them from working with their clients

High latencies associated with existing mechanisms limits flexibility, adds risk and hinders visibility into campaign performance

Result:

Untapped Customer potential. Frustrated staff. Slow and limited revenues and increased risk as a result of all the delays

Loans the Confer Way

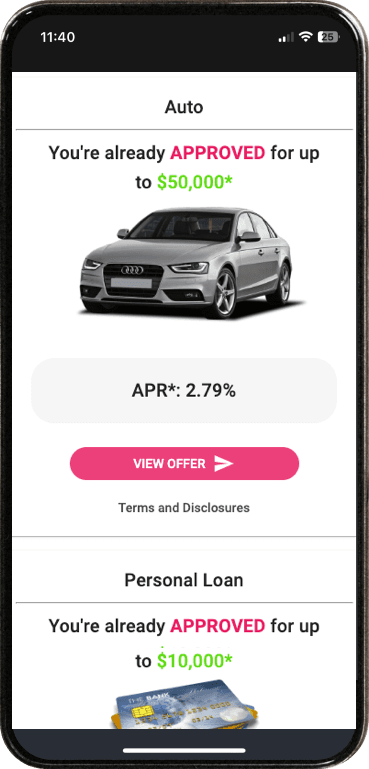

Existing customers are served pre-approved loan offers as per your requirements during their daily digital interactions with you. This makes the offers more visible

The paper work is pre-filled and the customer can quickly submit any additional information you need alongside requested changes within parameters you allow

The application can be either automatically validated and accepted or forwarded electronically to one of your loan officers to approve

Internal reporting tools made available to your staff enhance overall visibility and allow for the tracking of loan volumes on a real-time basis

Result:

Happier customers. Higher loan volumes. Better use of your resources.

Confer Lending Platform

Built around latest Internet/Mobile design standards and best practices to drive performance, scalability, and interoperability

Built to be configured to your needs; Designed to plug & play with your back-office systems (e.g LOS, Mobile & Online Banking, DataWarehousing, CRM)

Out of the box administrative tools to improve visibility into loan volumes and boost productivity; Real-Time with intelligent decisioning capabilities